Commercial crime insurance protects against loss from damage, destruction or disappearance of the insured’s own property as a direct result of crime.

Here are some important things to note:

Commercial crime insurance is a type of property insurance designed to cover the loss that an organization suffers from damage to, or destruction or disappearance of, its own property as a direct result of crime.

Crime insurance only applies if the loss results from the man-made event of crime, such as theft, fraud, or embezzlement. This insurance doesn’t pay out if the property is damaged from a random weather event, or from an accident.

Commercial crime insurance policies are relevant to any commercial organization that is not a financial institution. For financial institutions, similar coverage is provided by financial institution bonds that address the unique crime insurance requirements of that regulated sector.

Organizations buy commercial crime insurance to limit the negative financial consequences of crime. They buy it to protect the organization’s balance sheet, to ensure that crime cannot and will not hurt the long-term viability of the organization.

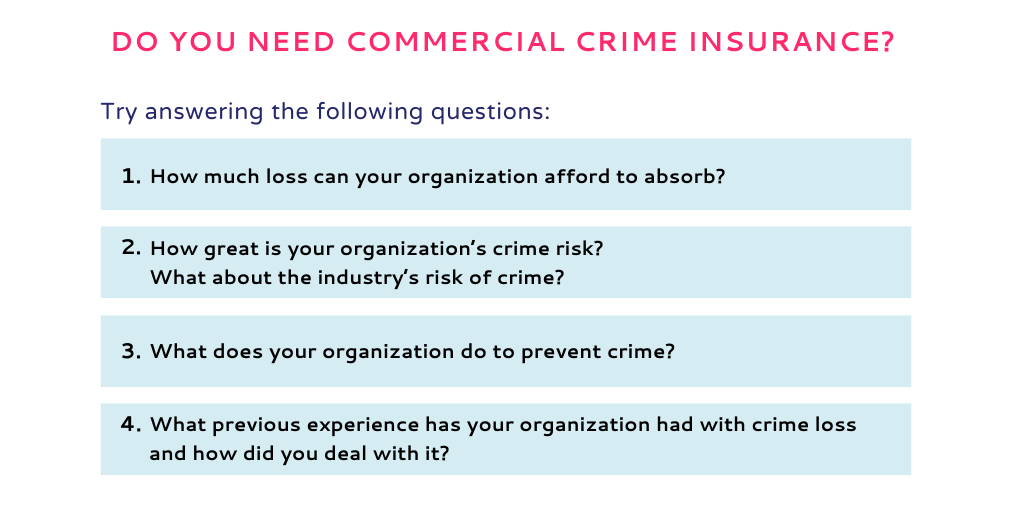

While no organization is impervious to crime, exactly how an organization best deals with the risk of loss from crime will and should vary.

No two organizations are the same, they have different financial situations, different levels of risk and risk control, different employee cultures etc. all of which impact their need for insurance and ability to absorb and deal with the impacts of crime.

The Association of Certified Fraud Examiners (ACFE) conducts an annual global study of occupational fraud and abuse. According to the ACFE 2020 report based on their 2019 survey, the median loss per fraud worldwide was USD125,000 and for North America, USD120,000. What’s more, 54% of the 2504 organizations victimized did not recover any of their losses. While large organizations may be able to absorb the occasional loss, for smaller organizations, a loss of that size can be devastating – especially if it’s not a one-time event.

To learn what may be covered by your commercial crime policy you will need to review the policy’s insuring agreements. A commercial crime insurance policy defines what the policy covers in one of the two following ways:

An “all risks” crime policy includes one or two insuring agreements that are very broad and general. For example:

The insurer will reimburse the insured for losses discovered during the policy period provided that the loss was sustained by the insured by reason of internal fraud or external fraud.

Note that the above agreement makes no reference to what kind of fraud, other than if it is internal or external, so it could be telephone fraud or computer fraud etc.

When you’re looking to purchase this kind of policy it’s important to realize that although the agreement wording is very broad, that doesn’t mean the policy covers everything. Read the policy carefully. You’ll find a detailed list of all the things that the policy may not cover in the exclusions section. Coverage may be further refined by the policy definitions as well as the terms and conditions.

This kind of commercial crime policy is not common in North America.

A “named perils” crime policy includes multiple insuring agreements that are specific and focused on what they cover. For example:

The insurer will pay the insured for direct loss or, or direct loss from damage to, money, securities or other property sustained by the insured resulting from computer fraud.

Most commercial crime policies in North America look like this.

With a named perils policy, in order for a loss to be covered, the crime that caused the loss must be named in the policy’s insuring agreements. Anything that is not listed in the insuring agreements may not be covered by the policy.

Commercial crime insurance policies of this type have numerous insuring agreements, often ten or more. The specific insuring agreements included depend on the insured organization’s insurance requirements.

Each insurance policy is written differently. Insurers apply different conditions for coverage depending on who commits the crime and how the crime and resulting loss fit – something that insurance buyers need to be aware of.

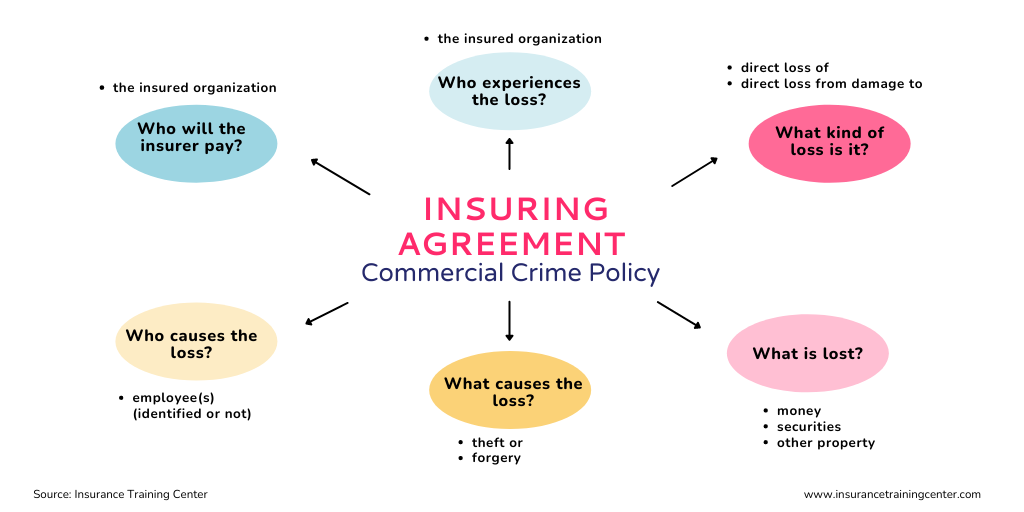

Here’s an example from a named perils policy:

Employee Theft: The Insurer will pay the Insured Organization for the Insured Organization’s direct loss of, or direct loss from damage to, Money, Securities, and Other Property with an Insured Organization sustains, directly caused by Theft or Forgery committed by an Employee, whether identified or not, acting alone or in collusion with other persons.

That single paragraph contains a lot of very specific information. It clearly states:

The separation between employee and non-employee insuring agreements is unique to crime insurance policies. The reason crimes committed by employees vs. other people are treated separately in a commercial crime policy comes down to history and how this type of insurance evolved over the years. What began as an insurance product addressing loss from employee crime, was later expanded to include loss from other crimes against the organization.

The most common commercial crime insuring agreements in a named perils insurance policy include both employee and non-employee insuring agreements.

Commercial crime policies are available with either one or the other of two different claim reporting formats: loss sustained and loss discovered. When purchasing a policy, the insurance company may offer buyers the option of selecting which approach they prefer. Before making a purchase decision, take time to understand the different claims reporting rules, how they work and the implications of each.

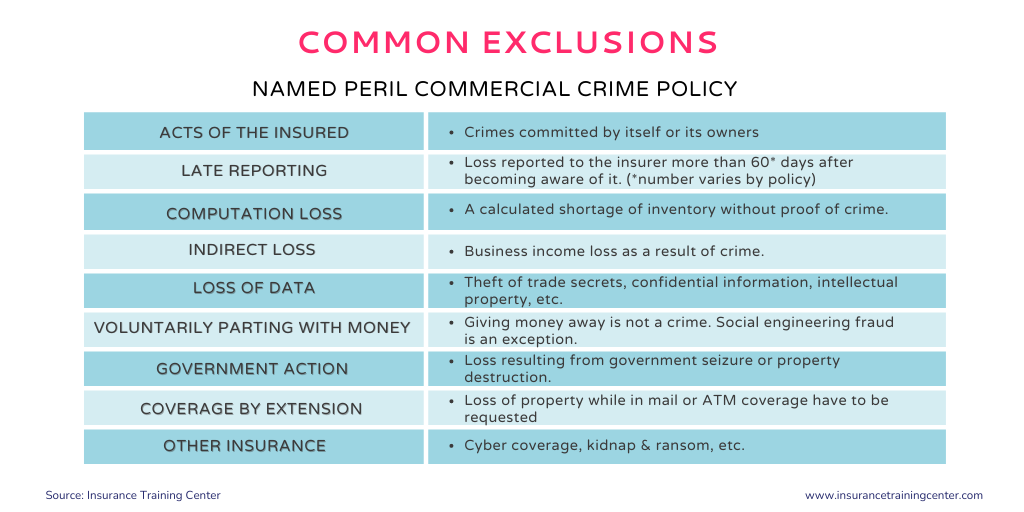

Insuring agreements state what the policy intends to cover and are subject to the policy’s exclusions, definitions, and terms and conditions. Depending on the policy terms and conditions, commercial crime insurance generally won’t cover losses:

The above is not an exhaustive list. Insurance buyers should always review their commercial crime policy carefully. Ask for clarification where necessary and ensure you have a clear understanding of policy coverage.

Learn about selecting an insurance provider for your commercial crime policy.To price a commercial crime policy, an insurance company needs to assess what risk it would be taking on by providing that policy.

The following are factors that will impact pricing:

If an organization has not invested in managing its risk, the insurer will see it. As a result, insurance will be expensive or simply not available. So, the guidance is: invest in sound risk management first – then call for insurance.